st louis county mn sales tax

Louis County Auditor 100 N. To further accelerate investment and.

State of Minnesota Department of Natural Resources.

. The ability to pay property taxes through a mobile device is currently not functioning unless your mobile browser is set to the Desktop Site view setting option. Contact City of Duluth Planning and Development for permitted uses and zoning questions. The December 2020 total local sales tax rate was also 7525.

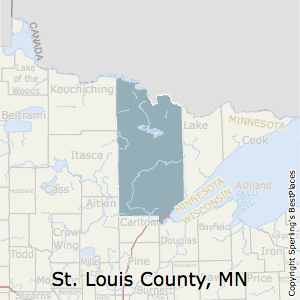

Located in the arrowhead region of Northeastern Minnesota St. Louis County is the largest county east of the Mississippi River. The December 2020 total local sales tax rate was also 7375.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738. This is the total of state county and city sales tax rates. W Room 214 Duluth MN 55802-1293 Additional methods of paying property taxes can be found at.

Online payments can also be made on a. The large living room has a wood burning fireplace and large windows for abundant natural light. Clerk of the County Board.

Located in the arrowhead region of Northeastern Minnesota St. November 15th - 2nd Half Agricultural Property Taxes are due. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is.

Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. These parcels are subject to a MN Department of Transportation right of way easement. Property Tax assistance is available through application at.

Complete Policy Manual of the St. Louis County Courthouse 100. Welcome to this attractively updated home in desirable St Louis Park.

Minnesota has a 6875 sales tax and St Louis County collects an additional NA so the minimum sales tax rate in St Louis County is 6875 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in St. The Minnesota state sales tax rate is currently 688. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No.

Saint Louis County MN currently has 253 tax liens available as of June 5. Saint Louis County Sales Tax Rates for 2022. Louis County is known for its spectacular natural beauty lakes and trout streams.

Louis County Sales Tax is collected by the merchant on all qualifying sales made within St. The kitchen has been recently remodeledwith Cherry cabinets stainless steel. 4919 W 28th St Saint Louis Park MN 55416 425000 MLS 6188374 Charming curb appeal.

The current total local sales tax rate in Saint Louis Park MN is 7525. Did South Dakota v. Louis County local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

The 2018 United States Supreme Court decision in South Dakota v. Mail payment and Property Tax Statement coupon to. The County sales tax rate is.

All contractors or sub-contractors operating in our gravel pits that are managed by the Land Minerals Department on Tax Forfeit Land must be on the Responsible Operators List. Saint Louis Park Details Saint Louis Park MN is in Hennepin County. Auditor - Mall Service Center.

This - 50 x 125 tract is zoned R-1 Residential. Learn more about our history public. This 05 percent transit tax applies to retail sales made within St.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. The Minnesota sales tax rate is currently. Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands.

Beautifully remodeled home to show off the hardwood floors n. Tax-forfeited land managed and offered for sale by St. The current total local sales tax rate in Saint Louis County MN is 7375.

Louis County is known for its spectacular natural beauty lakes and trout streams. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St.

This is the total of state and county sales tax rates. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Saint Louis County MN at tax lien auctions or online distressed asset sales. The St Louis County sales tax rate is 0.

These buyers bid for an interest rate on the taxes owed and the right to. The transit use tax applies to taxable items used in the County if the local sales tax was not paid. 2 beds 1 bath 1931 sq.

Much of the area has been built on the history of logging and the abundance of iron ore. See details for 2200 Quebec Avenue S Saint Louis Park MN 55426 Single Family 3 bed 2 bath 1526 sq ft 460000 MLS 6203787. They also are required to have liability insurance and workers comp requirements that meet.

The Land Minerals Department manages just under 900000 acres of tax forfeit rural land and 13000 urban parcels. Instructions on how to make this change can be found here. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

This entails attending the Gravel Training Session held in the spring or complete a Pre-Work Session online. Parcels vary in size from a few square feet to 100s of acres. Louis County is the largest county east of the Mississippi River.

US Sales Tax Rates. The right to withdraw any parcel from sale is hereby reserved by St. The St Louis Park sales tax rate is.

The total sales tax rate in any given location can be broken down into state county city and special district rates. You can find more tax rates and allowances for Saint Louis County and Minnesota in the 2022 Minnesota Tax Tables. What is the sales tax rate in St Louis Park Minnesota.

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com 2022 Best Places To Live In St Louis County Mo Niche Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 154 And Get 33 Off Which Are The Most Dangerous Places In Saint Louis Quora. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval.

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Plat Map St Louis County Mn Sema Data Co Op

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Best Places To Live In Saint Louis County Minnesota

File Your Taxes For Free Human Development Centerhuman Development Center